What About That Stock Market?

ClubHombre.com:

-Off-Topic-:

-Stock Market:

What About That Stock Market?

Don Marco

Ben and Kendricks moved but are still active.

TASR is on my watch list as they have a pretty solid balance sheet. Technically they are right around the 200dma. I would wait for visibility into the SEC inquiry before buying tho... the range in '04 was around 7-35, so even a drop to 17$ still leaves plenty of room for potential bloodshed due to profit taking.

Well if yur out there ben and kendricks-- good luck!

-DM

Don,

Any opinions on Taser's competition? LENF.ob might have a bright future. It wont have the appreciation that Taser did, but could be a double this year.

WOW since I made the post on TASER, it's popped up 5 bucks in two days... Nice, but too bad I was on the sidelines.

As for LENF-- I don't know the company, but looked over the balance sheet. The fundamentals on this company are horrific... I wouldn't go near it as a long term holding. However, if your a technical trader, the chart is quite bullish and the stock is showing definite strength. My opinion-- fine for a trading stock, but keep tight stop losses in place.

-DM

Anyone have a short list of stocks heading for a split?

Google seems like a good candidate but have heard nothing.

Don, I was on the sidelines as well. It is such a news-driven company that you can toss the charts out the window

| By Athos on Saturday, March 12, 2005 - 11:25 am: Edit |

Anyone ever purchased ETF or Closed end funds?Both trade like stocks but for the life of me, I cannot tell the difference. I am thinking of investing money in Brazil for a few months.

The nice thing about ETF´s are you can short them without an uptick.. An ETF is a form of a closed end fund (just passively managed vs a Portfolio manager for a closed end and regular mutual funmd). Another nice feature of an ETF is the internal (hidden) fee is probably lower than that of a closed end fund (although not always the case). I hope that helps. You can probably find good resources online at the American Stock Exchange on Country ETF´s

I hold about 15-20 different ETF's in my portfolio. I won't even buy a mutual fund anymore; ETF's are it for me when I want something beyond a single stock. The fees are much, much, much lower, and I love the way they can be traded like a stock.

Check out the Barclay's site for information on their iShares line of ETFs. Ton of information there. I'm in several of their foreign ETFs.

I have been in institutional research sales for close to a decade now. I cover mostly hedgefunds and asset mgrs in the NY metro area. Anyone willing to share their contacts in the Brazilian market? I am willing to share mine. best - LB

| By Laguy on Sunday, September 14, 2008 - 07:39 pm: Edit |

I'm not looking forward to the market Monday morning. Things look very scary right now.

| By Bullitt on Sunday, September 14, 2008 - 11:40 pm: Edit |

Its nice to not see a government bail out, although, it makes me wonder what good did the Fannie Freddie deal do. The New York Times called it (One of the most dramatic days on Wall Street). And this was on a Sunday! Yet, I think I am going to invest in the green ink and paper the govt makes dollar bills out of.

Lets see the feds guaranteed $29 billion of our tax dollars when JPMorgan Chase bought out Bear Stearns. You got Fannie and Freddie, and now Lehman Brothers.

Word is that hundreds of smaller banks are going to fail in the coming months with some larger banks going with them.

When was the last time our nation saw this number of banking institutions fail? Then next administration is going to have a hell of a mess on it's hands.

RG.

Anyone who is still invested in financials at this point pretty much deserves to loose their money. I am glad to see the government finally showing some restraint on the bail outs. Better late than never.

I am not sure where to post it, so I will post it here. I have never been so nervous about our country as now. John McCain is blaming all of this on greed and mismanagement but the fundamentals are strong. He is clueless. The problem is that the fundamentals are falling apart. Let's take a look:

1. During my entire lifetime the dollar has been strong, and now it is weak. Furthermore, the huge cliff all happened in the last 5 years!

2. This is what Bush never understood. A strong dollar is critical to keep energy costs affordable. Conversely a weak dollar is hugely inflationary, since there is little price elasticity in oil pricing.

3. China has been artificially propping the American economy. Why? Because if they put the money into their own economy, there are concerned it will overheat.

4. The one advantage (if you can call it that) of a weak dollar is that foreign capitol was flooding the market, which I believe is the core of this mortgage (Gold Rush mentality) crisis.

Here's the newsflash to Mr. Bush. No banking system is inherently sound without the trust of the people inside of it. As soon as trust is lost, the wheels fall off the bus.

Me personally. I have already sold all of my stocks except for a low six digit number. I am going to sell of that tomorrow. Just as an FYI, FDIC is only $100,000 per account. Furthermore, for the investors, there is only $500,000 on investment accounts. Not much insurance in my view. Next, I am moving at least a third and probably more like a 1/2 of my liquid assets to Brazil.

This is the biggest mess I have seen in my lifetime and I want to be far away from it as it gets worse.

| By Bendejo on Monday, September 15, 2008 - 07:57 pm: Edit |

Blues:

> This is what Bush never understood. A strong dollar is critical to keep energy costs affordable. Conversely a weak dollar is hugely inflationary, since there is little price elasticity in oil pricing.

What W personally understands is no doubt very limited, but I'm sure you mean 'the administration.'

I think they knew exactly what they were doing: devaluing the dollar means upping the price of oil, which is traded in greenbacks, which means maximizing the number of dollars collected by those dealing in oil. In this sense, the policy has been a success. Who profits? Friends and family, of course. Bad for the country and the people? Like they give a shit. This is a president who doesn't read newspapers, remember.

Same with Iraq: another 'Vietnam' deliberately created to funnel funds out of gov't coffers and into private industry. But this time it wasn't just to companies involved in munitions, but services like support infrastructure. Strictly coincidental that one of the corporations that has done very well by this new approach is the one that the VP was CEO of before the 2000 election. Cheney is a Vietnam vet, served in the White under Nixon so for him it was just 'hey, let's do that again.'

The deficit was intentional, they couldn't build it fast enough.

Looking at it in terms of its true intentions this administration has been a success.

I went to have my taxes done in early 2003 and in chit-chatting with my accountant (this was when they were still putting the pieces in place in Iraq and the tanks hadn't rolled yet) I told him it was all for the personal gain of those in power, and he found my attitude sickening cynical; when we finished the business at hand he told me that next year I should take my business elsewhere.

Tsk tsk, cynical me!

LA guy.....i was hoping you would post an opinion and/or comment on the market today...JR

| By Laguy on Monday, September 15, 2008 - 09:26 pm: Edit |

Sorry Johnnyroc, but I'm too depressed to post much re the stock market (and the economy in general).

Having said that, what worries me is this could be much more damaging than the NASDAQ crash, which while brutal, was the result primarily of a bubble, not of a fundamentally bad economy. Just before that event Greenspan was worried about irrational exuberance; now he is worried that we are in the middle of the most fucked-up economy in his lifetime. If the futures are any indication, it looks like the stock market is going to open substantially lower tomorrow (i.e., Tuesday). I just hope things don't spin out of control.

The market will be falling further on Tuesday, right now the Asian markets are falling, The Japanese market is down 4.8% South Korea down 6.2% Hong Kong down 6.5%

The South American markets took a hit also. Brazil was down 6.2% so I don't think Bluestraveller should move his assets down there.

I think that there is going to be a run on Washington Mutual soon. Their stock fell 26% today . It's going to get worse before it gets better.

RG.

Iceburg straight ahead!!!! Hopefully this ship doesn't sink. This shit is getting serious. The administration's greed has done us all in. The Great Depression happening again doesn't sound impossible anymore. 401k's-down the drain. Hopefully a bank panic doesn't break out. The feds are going to cut rates again soon to ease the pain but it is just a band aid. Hey, the exchange rate is going up and that is all that counts. 1.81!!!

| By Buick on Monday, September 15, 2008 - 11:25 pm: Edit |

when the dot com bubble burst, i got destroyed in the market. i had a pretty sizable position in the SPY's (S&P 500 index). but i tried to be a man and hold tight through the dips. there were at least two really steep moves down in 2001 but the market recovered somewhat. i thought i was in good shape. then came Oct 2002. i was the epitome of capitulation, i'd seen my net worth cut by more than 50% and sold everything that day. including my large position in the SPY's. guess what, i sold just above $77 and that was literally the low for the SPY's btwn now and the late 90's. that was mid oct, by the end of oct, they were trading at $90. i got schooled, big time.

so from that lesson, when the market tanked in Aug 07. i sold pretty much everything, got to 10% stock and 90% cash. that was the first sign of problems and i wasn't going to ride it out like a man. now, i've added shares such that i'm at about 20% stock/80% cash.

i'm going to hit the buy button on tuesday morning (take my allocation to 25%/75%). we've seen big moves down several times now, aug 07, jan 08, mar 08, july 08, and now sept 08. i still think we'll see 10,000 on the Dow in the next month or so but i'm going to start buying now and then go to 35%/65% when we hit 10,000.

in a year, i'm hoping the allocation will end up at 50%/50% by virture of stock gains, no addtl cash purchases.

my main long term holds are JPM, WFC, BDK, EMR, UST (just got bought !!!), YUM, LLY, GE, PM, PFE (worried about this one), VLO (just moved into this one). these companies will be around in the future and the stock price will go back up sometime. in the meantime, they pay dividends (3% to 7%) and i write calls on them often to help juice the income.

by the way, my next targets are RWX, EZU, EEM, XLB, and DIA. all ETF's that have good yields. real estate, europe, emerging markets, materials, and the DOW. not the hottest sectors right now, falling fast. but they will be higher three years from now and you'll earn 3% to 4% from the div while you wait. if my target investment is $10,000 in each one, my first purchase will be $500 for each. limping in, not going all in.

don't know if this helps anyone but this is my story. it was a sad tale in oct 02 but i feel pretty good right now.

| By Itasca on Tuesday, September 16, 2008 - 05:13 am: Edit |

Blues ... The only thing about moving assets to Brasil as I recently found out, is that they don't pay shit in interest. I mean fuck, they charge 12%-14% interest for loans, and pay .08% on savings accounts and that's only with a mandatory balance. Then they have something from what I understand to be a CD, but that only brings you up to a whopping 1.8% or something equally ridiculous for tying your money up for 6 months or more.

I've asked multiple people about the options of storing money there, but there doesn't seem to be a viable option to take advantage of the high interest rates. If I am missing something, someone please PM me.

Buick ... you are correct that you generally want to be buying when fear is at it's greatest (witness the sky is falling post above). It's not the end of the world, but you have firms going under that have been in business for 150 years. It has nothing to do with the economy though, but with bad business decisions by some on Wall Street and by a small percentage of home buyers that took out mortgages they couldn't afford. The volatility index is at it's highest point this year, which means that more people are buying puts because they think the market is going to go down further. That is usually a contrarian indicator. The same thing happened in March when Bears Stearns went under.

However .... I'd be careful this time. This meltdown that is occurring hasn't reached it's apex and there is a snowball effect that is occurring which has a lot of seasoned pros on edge because no one is sure where or when it is going to end. There are a lot of companies that are going to continue to be affected by this. And a lot of the selling that has been occurring lately (of good stocks) is because of forced liquidation by hedge funds etc. They are selling the "good stocks" because they are getting margin calls etc. So with that, I'd would wait until I saw a definite up trend. You don't have to be the first one in to make money.

One thing is for certain ... AIG can't be allowed to go under. It's too big to fail, and whatever the costs, it must remain solvent.

1.84!!!!

| By Laguy on Tuesday, September 16, 2008 - 08:44 am: Edit |

One dollar and eighty four cents. That is about what my stock portfolio is now worth.

I just sold more stock today. I about 90% cash now.

Itasca,

My experience has been the opposite of yours. Brazil pays high interest rates. I just opened up a new account at HSBC and the low risk rate is 1%/month, and the high risk rate is 1.5%. At Banco do Brazil, in addition, they have an automatic sweep into checking. So therefore you can keep your money always in the market and only sweep out when you do a debit or write a check.

I bought stock on the open this morning.

The market has been very hard for the average investor lately. Too much volatility.

I think there is more pain to follow, but if you have a long term outlook you will be able to build some really good positions.

The big worry is the FDIC and bank runs. The FDIC has only 50 billion in reserves. Wamu alone would take 25 billion. I hope that congress funds the FDIC very soon.

I am Happy to see Goldman Sachs finally admitting they are not immune.

| By Laguy on Tuesday, September 16, 2008 - 11:57 am: Edit |

Anyone selling antacid futures? The way the market has been behaving today would seem to make that a good investment.

bluestraveler, i too know of people in rio that get 1 to 1.5% per month on there deposit. my friend , whom you might know collects his interest on the first business day of the month in reals and lives very well all month on that.

| By Itasca on Tuesday, September 16, 2008 - 04:50 pm: Edit |

Blues ... I'm embarrassed to say, but after talking to a friend of mine in Brasil tonight, she cleared up that the interest rate she was referring to last month was per month. She said they advertise them per month there instead of per year. I was used to hearing it in terms of APR. So the .8% is per month so that is actually works out to 9.6% a year but not as good as the one you are talking about.

I'm going to PM you about this either tonight or tomorrow.

| By Xenono on Tuesday, September 16, 2008 - 07:02 pm: Edit |

So will someone please explain all these FED bailouts to me?

Here is how I understand them.

All these banks and companies made bad bets and investments based on deregulation, led mostly by Phil Gramm in the early 00's. They are now losing their ass.

Some have been deemed by the government "too important" to fail, so the FED is essentially bailing them out.

So now these companies and investors who made bad bets and decisions are being rewarded for their bad decisions by the government and won't lose their asses like they should.

This sounds an awful lot like socialism for the rich to me and will only delay what should need to take place now anyway.

Any fiscal conservative who rails against socialized medicine or Federal programs to help to the poor should be raising hell about these recent government bailouts....

Oh wait. They are probably investors in these companies, etc.

And who is going to pay for this? Instead of the investors who made bad bets, I now have to pay for it. And so do you!

(Message edited by xenono on September 16, 2008)

The mortgage crisis is the greatest redistribution of wealth from the rich to poor of all time. Democrats should be loving it. I am not shitting you if I tell you the parking lot where I work is filled with BMW's, Mercedes', and Lexus's that belong not to management or other high level employees but instead belong to $8/hr unskilled workers. They all bought ghetto homes 10 years back for 60k-80k. Refinanced half a dozen times as bankers showered half million dollar buckets of cash on them based on the fact that some dumbass appraised their ghetto home at 500k a couple of years back. They had a great run with the half million, now it is gone and they are getting foreclosed on but they none the less got to blow a half million which is more than most poor people get to do. Banker is left holding a ghetto house and a out the half million. Poor dude has no ghetto house any more but is left holding a BMW with $5,000 rims on it and a $8,000 stereo , 16 cell phones, $12,000 home entertainment center and a legacy of $20,000 parties.

But as for bailouts, it is all very wrong. If an investor bought the ticket he should be in for the ride. I have made bad investments before. I just took my lumps, learned something, moved on and did better next time. I never expected anyone to bail me out.

What you are seeing is financial Darwinism taking place. It must run it's course.

| By Buick on Tuesday, September 16, 2008 - 10:59 pm: Edit |

itasca,

your advice is very sound. i re-read my message and the statement "take my allocation to 25%/75%" (from 20%/80%) wasn't worded properly.

should have been "start to move my allocation to 25%/75%". i wasn't planning to move a full 5% of my holdings from cash to stock in one day. same holds true for my 35/65 comment. i will begin the process in increments.

i moved 0.40% from cash to stock at the open. will do similar moves on dips from here and i'm prepared to see the market fall another 20% from here.

by the way, good call on AIG, the rescue came. i owned AIG but got stopped out at $71 about a year ago, had a very small profit. whew !!

unfortunately, i also owned C and had no stop loss in place. in at mid $40's and before i could blink, i had to fire sale at $30.

oh well, i could go on forever with the stock trade stories.

good luck to everyone with their investments.

LA guy....do you think GE is a good buy at $25?

| By Laguy on Wednesday, September 17, 2008 - 07:07 am: Edit |

Johnnyroc . . .  I have no friggin' idea.

I have no friggin' idea.

LA guy....i just checked... GE is down to $23 and change.. a good stock i always make money with is ICAD. its under $4 now. i am gonna wait til it hits 3.75 and pounce.

| By Catocony on Wednesday, September 17, 2008 - 08:10 pm: Edit |

Morgan Stanley is going down next, that will leave Goldman Sachs as the last man standing - at least until Wells Fargo snaps them up.

What a bloodbath.

| By Itasca on Thursday, September 18, 2008 - 04:46 am: Edit |

Well, let's get a couple of things straight. There is enough blame to go around and blaming one political party or one race for this immediately discredits you.

And people keep referring to this "bailout" of AIG. It wasn't a bailout unless you consider a loan at 12% a bailout. That's Brasilian like, and the Fed/tax payers are likely to make money on this deal given time.

And the importance of saving AIG wasn't about saving some rich guy's money on Wall Street. It was about saving the 70 yr old man's life insurance policy that he had been paying on for 30 years. AIG just got caught up in all of this shit because banks took out insurance on these (what would turn out to be) bad loans. That is why I said that it was too big to allow to fail. AIG had intl exposure also, so this would have snowballed around the globe if suddenly insurance policies were worthless.

As for the immediate market future, I think we are due for a snapback rally today or tomorrow. You can't go down 1000 points in a couple of days and not have one usually, but I still think the trend is lower so I would be careful about buying any stock. In fact, I would sell into the next rally. And whatever you do decide to buy over the next month or so, if you finally decide on 100 shares or whatever, I'd half it ..... whatever you decide, because you are more than likely going to be able to buy the other half at a lower price in the future.

The good news for Brasil lovers is that the Real is back to 1.887.

The bad news is that I don't have any fucking money left to enjoy it. ;)

Just a quick update. I moved a large 6 figure number of dollars from US to Brazil. It took two full days for the money to show up in my new HSBC account here in Brazil. The delay worked in my favor because my rate was 1.84 real/dollar. They put me in three different funds all of which are paying about 1%/month. These are the low risk funds. The high risk funds in the last month have all been negative return because of the performance of the Brazilian stock market. I am going to stick with low risk stuff.

While I can certainly believe there are funds that are paying 1%/month, common sense would dictate that is either not typical over the long term or else not "low risk". I would certainly want to understand those investments much better than that before they got a hold of my money.

good move Bluestraveler....

| By Catocony on Thursday, September 18, 2008 - 01:28 pm: Edit |

I've had an account in a Panamanian bank since 1996. It's paid out anywhere from 23-29% annually, and since it's in dollars, no Forex exposure. Of course the new IRS rules a few years back killed the main benefit - using a credit card linked to that account for all of my business expenses, then taking the expense checks from work and putting them tax-free into my US account - but still, that account has done very well over the years. I've never had a problem moving money out, nor the credit card use back in the day.

I am Sancho,

Actually, when I opened my first bank account in Brazil, interest rates were much higher. About 1.5%/month. Since 2003 to 2008, it had actually fallen to about 10%/year, but recently risen to 1%/month. Most forecasts are for interest rates to rise slightly in Brazil. In 2003, Brazil;s interest rates were some of the highest in the world, which is one of the reasons that I found the country so attractive.

Cat,

Is your bank account a sweep checking account? So your money is always in your investment fund? Is your Panama interest rates considered high or low risk?

Also, one problem with HSBC is that they do not have automatic sweep. You have to manually move the money between your investment account and your checking account They tell me that Banco do Brazil is the only bank that has a sweep.

Not disputing the returns. Not even saying it is a bad idea. Not even saying it is something I wouldn't do myself. Simply saying that if banks are paying such a premium return for cash, there is obviously an underlying risk factor that is above, "low".

| By Itasca on Friday, September 19, 2008 - 03:39 am: Edit |

Well, I'm currently stuck with an Itau account for reasons I won't go into. Let's just say that they were the only ones that would let me open an account, but hopefully that will change soon if the immigration office finally gets off their asses.

I don't know what type of account I have to tell you the truth. I don't think it's earning any interest. I don't see any coming in when I look at it online. I have an ATM card, (no checks) and that's about it.

Back to the stock market, what they are talking about doing now is changing my forecast a bit. I don't know how they are going to do it in an orderly way, but they are trying to take some or all of the bad debt off the books of banks so they can start lending again. Also, the SEC has short sellers in their sights, so I don't know what is going to happen with that.

In any event, I think both items are short-term bullish for the market. This is a great trading market by the way. If you look at some of the daily spreads in stocks, it's ideal for a trader.

"The Day the Music Died", today was taken right out of Atlas Shrugged. Bush and his mob castrated the shorts. Now any illusions of a free market that existed are gone. Another example of how the "baby boomer" generation has sold their children and grandchildren into slavery. It makes me sick.

But it will be easy for anyone to pay their $500,000 Mortgage when $500,000 is only like 50 US Nuevo Dólares in a few years.

September 19, 2008

Dear TradeStation clients,

IMPORTANT MESSAGE:

Due to the industry impact of today’s Securities and Exchange Commission emergency order on short selling (the SEC Order), EFFECTIVE IMMEDIATELY, we will not be able to facilitate short sales for any of our clients in any of the Financial Firms included on the list attached to the SEC order. The SEC order is in force until October 2, 2008 unless further extended.

IN THE EVENT ANY CLIENT ATTEMPTS TO ENTER A SHORT SALE IN VIOLATION OF THIS ORDER WE WILL IMMEDIATELY CLOSE OUT THE POSITION AND THE CLIENT WILL BEAR TOTAL RESPONSIBILITY FOR ANY LOSSES SUFFERED OR LOST OPPORTUNITIES REALIZED AS A RESULT OF THE BUY-IN.

For additional information, please visit the SEC website at www.sec.gov. or contact the Trade Desk at (800) 871-3563.

| By Xenono on Monday, September 22, 2008 - 08:33 pm: Edit |

*

(Message edited by xenono on September 22, 2008)

| By Xenono on Tuesday, September 23, 2008 - 08:40 pm: Edit |

The beginning of this video is very good and illustrates nicely a proven track record and formula this administration has used before to get something speedily approved.

http://www.youtube.com/watch?v=S27yitK32ds

The way the Bush Administration is handling this crisis is classic and we have seen this script oh so many times before. Substitute financial crisis for Al Qaeda or Iraq and you have the legislation that was rushed to be passed after September 11th that gave us the Patriot Act and other similar laws that reduced our freedoms and liberties. The same game was played in the Iraq War resolution where Bush said the proof would come in the form of a mushroom cloud.

Same thing now, different crisis. The administration says we must act now, there can't be any debate or oversight and everyone just needs to just shut up and go along with what they say.

Given their track record, they have absolutely no credibility whatsoever to lead during this crisis. I just hope the Democrats don't roll over like they did in 01 and 02. They probably will, but I hope they don't.

After this goes through the Bush Administration's failure will be complete. 20 or 30 years later this country will still be digging out from the mess eight years of Bush II created, if we can recover at all.

| By Xenono on Friday, September 26, 2008 - 09:44 pm: Edit |

Hmm. Stewart's take similar to mine above

http://www.thedailyshow.com/video/index.jhtml?videoId=186052

| By Porker on Friday, September 26, 2008 - 10:51 pm: Edit |

Xen, great links, thanks.

Makes one wanna WEEP, though...

| By Xenono on Saturday, December 20, 2008 - 11:21 pm: Edit |

Decided to login to the ole 401K site today to see how the 401K plan was doing since the start of this plan.

"Your rate of return from 05/01/2008 to 11/30/2008 is -39.1%."

Not so good...

| By Layne87 on Thursday, February 26, 2009 - 03:25 am: Edit |

Well you have to give credit where credit is due...bluestraveler made the call mid sept...I was not in agreement with his call..guess its why he has more $$$ and already retired..good call ole friend..

Don't worry..good ole Jack & Jeffrey are circling the wagons....

Geez, I hope they beat by a penny with all that TARP money.

Well, I quess I weathered the stock market fairly well.

With the gains yesterday I'm now back to even with where my portfolio peaked in october 2007.

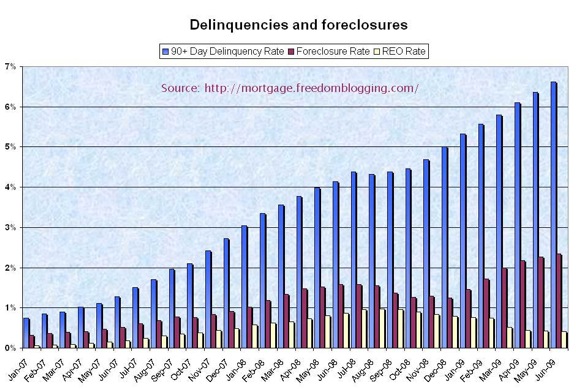

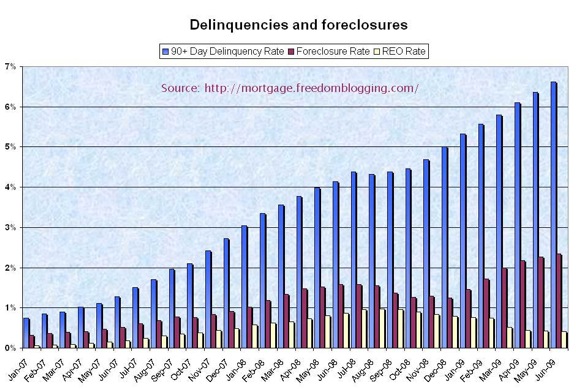

All these forclosures were first being reported around end of july 2007 and the markets peaked in august 2007 with a small correction following.

But the markets bounced back in october to set new highs, by this time there was a lot of news regarding these forclosures and using some indicators like price-to-earnings-ratio I was very confident we were headed for a huge, huge market correction and possibly a recession.

I pulled 50% of my money out of the stock market at it's peak in oct. 2007, I was touch and go to pulling 100% but decided against it. Damn what could-of-been.

I got most of that money back in with the dow around 7000, and have scored big time since.

I put my largest stake in fidelity's finacial services mutual fund, even though all the experts were saying not to go into finacials.

And I scored my best return in the fund with my largest stake, a 52.4% return since the middle of march.

I put a small stake in fidelity's japan small companies and scored big again, a 52.3 % return since middle of march.

Put a nice stake in fidelity's china region and scored 40.5% since end of april

By-the-way from everything I'm hearing china's the place to be, strong fundamentals and likely the 1st of near 1st to come out of the recession and get economy back on track.

Huge returns are available at big market correction bottoms, not saying it's easy to call the bottom, it's not, but once the market begins bouncing back you don't want to be left out, this is almost always were the biggest money is made. It's also when fear is at a alltime high and most would never dare go back in, but this is when you want to go back in.

I've been in the stock market since 1991 and pulled out money just 1 other time, that's when the nasdag rolled over 5000 and I was quite confident the tech bubble was ready to burst.

Then I pulled 100% out after catching about 35% downside.

The fundamentals of the nasdag were at or near the worst ever, but hystera was everywhere, even all the experts were saying it's a new era and the markets are immune to big corrections, well, quess what, wrong again experts.

I bought 600 shares of CMG a couple of years ago at around $41. When it hit $51 only a month or so later I sold it pocketing about $6K. I was estatic with my nice little profit. The stock then vaulted past $120 or so. Fuck! Hindsight really is 20/20.

Then as we approached October 2008 it fell to $95 so I bought 400 shares thinking it had bottomed. It then dropped to around $40. Fuck! I should have known better. Hindsight: When I let greed cloud my judgment I normally lose. It is my firm belief that my little play in the market was destined for failure due to my previous short win profit. Therefore, I apologize to all of you in the market when it collapsed. If I had anything to do with it, sorry, my bad.

But, when CMG fell from $95 to around $40 I didn't panic. Instead, I bit my lip and told everyone who knew about my misgiving that I'd sooner run it into the ground than sell it in a panic. I was screaming "fuck" all the way down. What a fucking roller coaster ride.

CMG is now hovering around $91 per share again. Fuck! Hindsight: I should have bought more when it hit $40 again...not too long ago, either.

Anyway, I wish I had more balls to buy when all the ships are sinking simultaneously. I know CMG is a great little restaurant. Cheap food at 6000 calories per plate is a big hit during a recession.

Do you think CMG will go to $140? I think it will. But, if I buy more it won't. Therefore, I am sitting tight. But to all of you looking for a stock that is bucking the trends...CMG has pretty good potential.

I'm going to put a stop loss on my CMG at $80. I don't want to take that ride again.

CMG = Chipolte Mexican Grill

AJ

My friend's brother is a member of The Motely Fool stock avisory service, every once in awhile he give me they're picks, I haven't bought any yet, but CMG is 1 stock they've been pumping up for some time now.

It has tremendous growth oppurtunities.

Buying more shares once a stock has fall'in is excellent stratery. Many people after losing money are to damn scared to buy anymore, but you only need a small rise to get back the money you previously lost.

I bought into Fidelity's networking and infasturucture mutual fund at about ther worst possible time, in july 2007 just before the forclosure starting making news.

It's one of the funds I didn't pull out of and it got hammered. In the middle of march I added to it, since then the new money added is up huge 49.5%. Although my orginal money is still down 27%, the total fund from july 2007 till now is up 12%, not a bad return considering.

The markets bottomed on march 9th and since then have scored huge returns. The big money is almost always made at market bottoms.

There's one industy now that still remains near it's bottom, it hasn't followed the markets rise.

It might be the next big money making oppurtunity.

When this industry turns the corner, look out,it very well could roll-up huge profits in a short period of time.

And eventually it will, it's only a matter of time.

That's the mortgage finance industy.

According to Fidelity's research it's down 76.5% last 1 year.

According to Barron's research it's down 80.97% last 1 year.

It's appeared to have bottomed.

With very little downside left but tremendous upside now's the time to start looking to get in.

Looking at Fidelity's home finance mutual fund, it peaked at about 53 in 2007 and bottomed at about 8 and is now at 10.28.

It's up just a small amount off the bottom and needs to rise more than 5 times to reach it's peak.

Considering that many funds have doubled off they're bottoms, and are only doubling or less than doubling to reach they're peak,this industry has not moved much yet.

A good example is fidelity's automotive fund, peaked at about 47 in 2007, got hammered after all the bad news hit similar to home finance, bottoming at about 9, once any good news came about it was all big money since, now at 28.22 or more than triple in 4.5 months.

It's now less than double from it's peak, yet home finance is more than 5 times from it's peak, tremendous upside, it's only a matter of good news coming and once it does, I for one won't be left out of another big score.

Well, the first piece of good news has hit, home prices are up for the first time and new home prices are up big, 11%.

This good news serves well for home finance.

Yesterday aug 4 with the markets up less than .5% fidelity's home finance fund was the 4th best performing fund in fidelity up 1.72%.

Today the 5th with the markets down home finance fund the 3rd best preforming fund up 1.97% easily beating the overall market.

A real estate fund was the top performing fund up 10% past 2 days.

There's so much upside and easy money coming it's silly.

totally silly man.... they should direct deposit it to your account. I'm sure real estate can only go up with 50% of all mortages underwater in 18 months.

http://www.reuters.com/article/GCA-Housing/idUSTRE5745JP20090805

This is the eye of the storm guys.

Beware of October 09. Plan well. Be extra conservative.

Elim

Why?

| By Mitchc on Thursday, August 06, 2009 - 10:00 pm: Edit |

October? If something bad is most likely to happen in October (whatever that means), would it not be best to short the market and not just be conservative?

I guess so Mitchc, yeah.................

Go for it!

I've settled into Gold, Silver and foreign real estate.

I am by no means a financial advisor, but I have many patients in that line of work from US hedge fund groups, and a bunch that work for foreign banks. I am only parroting here what they have told me in passing. Most of these downturns preent themselves in an October surprise, and many are scared this October will be pretty bad.

Who knows................

Do what you think is best based on who you talk to.

Elim

Geez man, they work for a hedge fund, that's their job to call for the markets to go down.

Fidelity's home fianace easily beats the overall market again, up 2.4%, that's up about 7.5% this week.

The same real estate fund rolled again , number 1 performing fund in Fidelity again up 6.06%, that's 16% in 3 days.

bluelight, thanks for the article, read it twice but couldn't make much sense of it. Seems they are expecting home prices to go down 14% by 2011, how's that possible when prices could be on the rise now.

This article basically confirms my beliefs, the best time to invest and score huge profits is when fear is very high, the article confirms this.

Get in when others won't. The worst news has already hit and investors have overeacted and oversold the morgage finance sector it now is undervalued, that's the key.

What looks to be happening now is the sectors with the biggest gains since march like the tech sector are no-longer beating the overall market and a shift is taking place, why, value.

With tech driven way up, investors are now looking for better value and morgage finance offers tremendous value and upside potential.

All it takes is a small amount of good news and it rolls, that 7.5% home fiance fund was up this week will look like pocket change in the weeks to come.

Well, the first big explosion has arrived in the morgage finance sector, it happened friday after the closing bell.

Freddie Mac reported earnings and it was good, the stock just exploded, up 72.97% in after hours trading.

And quess who rode it's coat tails ?? Fannie mae reported big losses but still up 28.79% after hours.

Things are so beaten-up that any good news will get good upside.

"YOU AIN'T SEEN NOTHING YET" this is just the beginning, it's still very early in the recovery, there's still plenty of time to get into the sector.

Foole:

"YOU AIN'T SEEN NOTHING YET" this is just the beginning, it's still very early in the recovery, there's still plenty of time to get into the sector."

You seem fantastically optimistic.

How can this economy be recovering as unemployment continues to rise?

Keep throwing money at the problem and the US currency continues to depreciate in the global currency market. These are not good things.

http://www.nytimes.com/2009/04/05/opinion/05sun1.html

http://www.nytimes.com/2009/04/05/opinion/05sun1.html

From my lay perspective, the market, especially now, seems volatile and untrustworthy. Recovery now without any real new generation of American industry seems like illusion to me. People are just not buying things like they used to.

Sounds like you know something though, so good luck and I hope no one here gets burned further. So many people have already lost life savings in the previous 'Unbeatable" US stock market.

Elimgarak, thanks for the articles, you think like the masses of people and are looking at the wrong things, this is why your going to miss out on the biggest gains.

It really doesn't matter what the economy looks like as based on that article, IT'S ALL ABOUT VALUE !!!

Does the morgage finance sector have value ???

When tremendous bad news hits a sector and that bad news keeps coming month after month as we've seen, then what happens is "INVESTORS OVERREACT GIVING THE SECTOR VALUE".

The sell-off is greater than the actual situation warranted.

With all the bad news, what happens is everyone that wants out has already sold, those that remain, are highly likely long term commitited investors. Therefore there's little downside, there's no-one left whom wants to sell.

This is also why you get in when fear is very high, because with fear high everyone that wants out has already sold and those that haven't sold aren't going to, follow.

Therefore all it takes is any less-bad news and the upside is enormous.

Let's look at one particular sector that's talk about in your article which presented this exact same senerio.

In the article it says that recovery are brought about by buying big ticket items like automobiles, and then it goes on to say there's little chance auto's will do well because it been so devasted, did you read this part, read it again and watch something.

AUTO'S HAVE BEEN DEVASTATED, that's the key phrase, remember buy when fear is high, GM and CHryster in bankrupcy , auto industry takes a beating, right, the stocks get pounded, EXACTLY LIKE IN MORGAGE FINANCE, see the similaritys ??

Typical overeaction by investors send auto stocks down big, therefore giving the sector value.

OK, here's the kicker, check-out barrons.com, do you know which sector is the number 2 ranked sector year-to-date, up and increible 128%.

You guess it, autos.

Why, it's so far beaten-up and way undervalued that any posible better news and remember any news will be better because the news prior was so DEVASTATED, and that my friend is the key word to it all.

Just like home finance, how can the news be worse, IT CAN'T, see my point.

What hit home finance is possibly the worst news ever to hit A sector in history, it can't get worse only better, that's the key, and that's why BEING DEVASTATED" as was talk about in your article is, believe it or not a good thing if your investing now, after the devastation has occured.

But readers who've read that article and see the words devastated will be far to scared to get in as yourself, and you'll also miss out on the big, huge gains that almost always come at the bottom.

Elim,

Because unemployment is probably the most lagging of all indicators, especially over the last 20 years? The last thing businesses of any size do is add employees. You first soak up any excess capacity that developed during the recession - even for service sector jobs, when it's simply "not as busy as it used to be". Second, you extend out your available resources - people work longer hours, overtime, etc. Then, any new efficiencies that this new expansion shows, you try to take advantage of. Finally, you start hiring people for expansion. You only do that when you're pretty sure you have some sustained growth and can fully justify the perceived risk of hiring someone.

So yeah, the recession is long over by the time employment starts perking up hard. Just like in 2001 or late 2007/early 2008 when the recession actually started. Unemployment didn't start rising for several quarters after the contraction started.

Unemployment/jobs numbers never tell you when a recession is starting, and they never tell you when one is ending.

Foole and Cat: Thanks for your info, as you guys really seem to know your shit.

Honestly, I've been burned in the market too many times to trust it now. Lost money once on advice to "go short," on a "sure thing." I didn't loose too much but just enough to say...... "FUCK!"

So you're correct. If there is money to be made as you suggest, I will be missing out on it. I wish you luck and prosperity in your endeavors however and hope you are correct!

Elim

Elim, there's always money to be made (and lost). The trick is being on the right side of the trade ;)

Don Marco: You guys may want to read this.

As far as what you note, I have certainly learned that the hard way. You can not do it yourself and need the advice of someone "in the know" or with substantial inside info. Too scared to try anything new with kids approaching college, I've moved to much safer long term investments. Maybe sometime later I'll dabble once more.

It is reports like this however, that keep me skeptical that things are going to get better any time soon; pasted here FYI;

Elim

This is No Recession

It's a Planned Demolition

By Mike Whitney

August 10, 2009

"Information Clearing House"

Credit is not flowing. In fact, credit is contracting. That means things aren't getting better; they're getting worse.

When credit contracts in a consumer-driven economy, bad things happen. Business investment drops, unemployment

soars, earnings plunge, and GDP shrinks. The Fed has spent more than a trillion dollars trying to get consumers to

start borrowing again, but without success. The country's credit engines are grinding to a halt.

Bernanke has increased excess reserves in the banking system by $800 billion, but lending is still slow. The banks are

hoarding capital in order to deal with the losses from toxic assets, non performing loans, and a $3.5 trillion commercial

real estate bubble that's following housing into the toilet. That's why the rate of bank failures is accelerating. 2010 will

be even worse; the list is growing. It's a bloodbath.

The standards for conventional loans have gotten tougher while the pool of qualified credit-worthy borrowers has shrunk.

That means less credit flowing into the system. The shadow banking system has been hobbled by the freeze in securitization

and only provides a trifling portion of the credit needed to grow the economy. Bernanke's initiatives haven't made a bit of

difference. Credit continues to shrivel.

The S&P 500 is up 50 percent from its March lows. The financials, retail, materials and industrials are leading the pack.

It's a "Green Shoots" Bear market rally fueled by the Fed's Quantitative Easing (QE) which is forcing liquidity into the

financial system and lifting equities. The same thing happened during the Great Depression. Stocks surged after 1929.

Then the prevailing trend took hold and dragged the Dow down 89 percent from its earlier highs. The S&P's March lows

will be tested before the recession is over. Systemwide deleveraging is ongoing. That won't change.

No one is fooled by the fireworks on Wall Street. Consumer confidence continues to plummet. Everyone knows things

are bad. Everyone knows the media is lying. Credit is contracting; the economy's life's blood has slowed to a trickle.

The economy is headed for a hard landing.

Bernanke has pulled out all the stops. He's lowered interest rates to zero, backstopped the entire financial system with

$13 trillion, propped up insolvent financial institutions and monetized $1 trillion in mortgage-backed securities and US

sovereign debt. Nothing has worked. Wages are falling, banks are cutting lines of credit, retirement savings have been

slashed in half, and home equity losses continue to mount. Living standards can no longer be bandaged together with

VISA or Diners Club cards. Household spending has to fit within one's salary. That's why retail, travel, home improvement,

luxury items and hotels are all down double-digits. The easy money has dried up.

According to Bloomberg:

"Borrowing by U.S. consumers dropped in June for the fifth straight month as the unemployment rate rose, getting loans remained difficult and households put off major purchases. Consumer credit fell $10.3 billion, or 4.92 percent at an annual rate, to $2.5 trillion, according to a Federal Reserve report released today in Washington. Credit dropped by $5.38 billion in May, more than previously estimated. The series of declines is the longest since 1991.

A jobless rate near the highest in 26 years, stagnant wages and falling home values mean consumer spending... will take time to recover even as the recession eases. Incomes fell the most in four years in June as one-time transfer payments from the Obama administration’s stimulus plan dried up, and unemployment is forecast to exceed 10 percent next year before retreating." (Bloomberg)

What a mess. The Fed has assumed near-dictatorial powers to fight a monster of its own making, and achieved nothing. The real economy is still dead in the water. Bernanke is not getting any traction from his zero-percent interest rates. His monetization program (QE) is just scaring off foreign creditors. On Friday, Marketwatch reported:

"The Federal Reserve will probably allow its $300 billion Treasury-buying program to end over the next six weeks as signs of a housing recovery prompt the central bank to unwind one its most aggressive and unusual interventions into financial markets, big bond dealers say."

Right. Does anyone believe the housing market is recovering? If so, please check out this chart and keep in mind that, in the first 6 months of 2009, there have already been 1.9 million foreclosures.

The Fed is abandoning the printing presses (presumably) because China told Geithner to stop printing money or they'd sell their US Treasuries. It's a wake-up call to Bernanke that the power is shifting from Washington to Beijing.

That puts Bernanke in a pickle. If he stops printing; interest rates will skyrocket, stocks will crash and housing prices will tumble. But if he continues QE, China will dump their Treasuries and the greenback will vanish in a poof of smoke. Either way, the malaise in the credit markets will persist and personal consumption will continue to sputter.

The basic problem is that consumers are buried beneath a mountain of debt and have no choice except to curtail their spending and begin to save. Currently, the the ratio of debt to personal disposable income, is 128% just a tad below its all-time high of 133% in 2007. According to the Federal Reserve Bank of San Francisco's "Economic Letter: US Household Deleveraging and Future Consumption Growth":

"The combination of higher debt and lower saving enabled personal consumption expenditures to grow faster than disposable income, providing a significant boost to U.S. economic growth over the period. In the long-run, however, consumption cannot grow faster than income because there is an upper limit to how much debt households can service, based on their incomes. For many U.S. households, current debt levels appear too high, as evidenced by the sharp rise in delinquencies and foreclosures in recent years. To achieve a sustainable level of debt relative to income, households may need to undergo a prolonged period of deleveraging, whereby debt is reduced and saving is increased.

Going forward, it seems probable that many U.S. households will reduce their debt. If accomplished through increased saving, the deleveraging process could result in a substantial and prolonged slowdown in consumer spending relative to pre-recession growth rates." ("U.S. Household Deleveraging and Future Consumption Growth, by Reuven Glick and Kevin J. Lansing, FRBSF Economic Letter")

A careful reading of the FRBSF's Economic Letter shows why the economy will not bounce back. It is mathematically impossible. We've reached peak credit; consumers have to deleverage and patch their balance sheets. Household wealth has slipped $14 trillion since the crisis began. Home equity has dropped to 41% (a new low) and joblessness is on the rise. By 2011, Duetsche Bank AG predicts that 48 percent of all homeowners with a mortgage will be underwater. As the equity position of homeowners deteriorates, banks will further tighten credit and foreclosures will mushroom.

The executive board of the IMF does not share Wall Street's rosy view of the future, which is why it issued a memo that stated:

"Directors observed that the crisis will have important implications for the role of the United States in the global economy. The U.S. consumer is unlikely to play the role of global “buyer of last resort”— other regions will need to play an increased role in supporting global growth."

The United States will not be the emerge as the center of global demand following the recession. Those days are over. The world is changing and the US role is getting smaller. As US markets become less attractive to foreign exporters, the dollar will lose its position as the world's reserve currency. As goes the dollar, so goes the empire. Want some advice: Learn Mandarin.

SAGGING EMPLOYMENT: A "no new jobs" recovery

July's employment numbers came in better than expected (negative 247,000) lowering total unemployment from 9.5% to 9.4%. That's good. Things are getting worse at a slower pace. What's striking about the BLS report is that there's no jobs-surge in any sector of the economy. No signs of life. Outsourcing and offshoring are ongoing, and downsizing is the new path to profitability. Businesses everywhere are anticipating weaker demand. The jobs report is a one-off event; a lull in the storm before the layoffs resume.

Unemployment is rising, wages are falling and credit is contracting. In other words, the system is working exactly as designed. All the money is flowing upwards to the gangsters at the top. Here's an excerpt from a recent Don Monkerud article that sums it all up:

"During eight years of the Bush Administration, the 400 richest Americans, who now own more than the bottom 150 million Americans, increased their net worth by $700 billion. In 2005, the top one percent claimed 22 percent of the national income, while the top ten percent took half of the total income, the largest share since 1928

Over 40 percent of GNP comes from Fortune 500 companies. According to the World Institute for Development Economics Research, the 500 largest conglomerates in the U.S. "control over two-thirds of the business resources, employ two-thirds of the industrial workers, account for 60 percent of the sales, and collect over 70 percent of the profits."

... In 1955, IRS records indicated the 400 richest people in the country were worth an average $12.6 million, adjusted for inflation. In 2006, the 400 richest increased their average to $263 million, representing an epochal shift of wealth upward in the U.S." "Wealth Inequality destroys US Ideals"

Working people are not being crushed by accident, but according to plan. It is the way the system is supposed to work. Bernanke knows that sustained demand requires higher wages and a vital middle class. But what does he care. He's not a public servant. He works for the banks. That's why the Fed's monetary policies reflect the goals of the investor class. Bubblenomics is not the way to a strong/sustainable economy, but it is an effective tool for shifting wealth from one class to another. The Fed's job is to facilitate that objective, which is why the economy is headed for the rocks.

The free market is a sham to conceal the crimes of the rich. Read Taibbi. Read Marx. Karl, not Groucho.

The financial meltdown is the logical outcome of the Fed's monetary policies. That's why it's a mistake to call the current slump a "recession". It's not. It's a planned demolition.

Click on "comments" below to read or post comments

Comments (10) Comment (0)

Comment Guidelines

Be succinct, constructive and relevant to the story. We encourage engaging, diverse and meaningful commentary. Do not include personal information such as names, addresses, phone numbers and emails. Comments falling outside our guidelines – those including personal attacks and profanity – are not permitted.

See our complete Comment Policy and use this link to notify us if you have concerns about a comment. We’ll promptly review and remove any inappropriate postings.

Sign up for our Daily Email Newsletter [

Elim,

You need to manage risk (financial and otherwise) however you are comfortable. With that said, I would highly recommend a good financial planner in your case.

Here's what I have learned over the past year. There are forces that none of us understand that impact the stock market in ways outside of the traditional supply/demand, P/E etc models. There are the forces that drove the inflation of the stock market beginning in the early 90's, and finally bust in the late 2007.

This force greatly impacts the volatility of the stock market. Which changes how I will forever view the stock market.

I have taken all of my money out of the stock market and put about 1/3rd of my money in CD's in Brazilian banks. Brazil interest rates are still standing at about 10%/year, and a lot of the CD's were purchased at an exchange of R$2.5/$.

I feel much safer in this scenario. Although it is true that for every buyer there is a seller. It is NOT true that for every loser there is a winner. There are many lose lose scenarios that have been unfolding.

BT, it wasn't meant as a literal statement. I would hope that is obvious to everyone, but the point remains...

Anyone saying the market is too risky and alluding to some failed hot tips, vague advice, or indirect macro economic indicators shouldn't be in the market as an individual investor unless they have some play money they don't mind losing.

Elim, sounds like you've been hanging around with to many hedge fund workers.

Article's like that are useless, every-one already knows much of that info, in other words that info is already priced into the market, why do you think the dow dropped below 6700 ??

Believe it or not, it's that exact info that gives you one of the best investment oppurtunities of a lifetime.

Did you know, most of those types of articles are proven wrong over time, we'll see how this one makes out.

One thing that caught my eye was the article saying we'll test the market lows of last march. This simply won't happen. It took some of the worst news in history to send the markets that low. Unless there's some god-awful event, like a war with north korea or another major terresorist attack, or some other unforeseen, unpredictable event, it's not going to happen.

One of the key things I learned from years in the stock market is, never, ever make a investment decision based on trying to predict a future event, make investment decision based on known facts and value.

In the article Duetsche Bank "predicts" home prices down 14% in 2011(well that was in bluelight's article, but talked about in your article) and that's why homeowners will be underwater with their homes.

They're trying to predict a future event, home prices in 2011.

No matter how smart some-one thinks they are, it's been proven by people who've tracked such things that no-one can consistently make accurate predictions of the future.

This article is assuming they are right, what if home prices are up 14% or 17, 18%, or 21%, then the entire basis of the article goes out the window.

I'll bet they're wrong !!!! They are wrong more often then they're right.

I quess we'll find out in 2011.

To give you an idea of the prediction powers of the experts, did you follow the markets downward fall ???

I was watching very closely and looking for the right time to get back in.

In January most experts on CNBC were calling for a market bottom, well the bottom Never came, in febuary the experts were predicting a market bottom again and once again it never came.

Enter march, now, for the first time the experts "STOPPED" calling for a bottom and said more downside would likely happen.

This meant fear was at a high point and a short time after the markets went up and has never looked back.

With fear high this means that everyone who wants out is probally out, and the remainder are long term investors, therefore there's no-one left to sell then there's little chance of going down, once the markets began to rise it was the key I looked for to get back in.

Just 5 days after the bottom I put 80% of my money back in the market and 15% of my portfolio went into a financial services mutual fund which at the time not 1 single expert was recommending financial services and a newsletter had a sell on the very fund I went into.

Well, the fund has rolled up a quite impressive 69% return to date, the best preforming fund I have, and not 1 expert was recommending it.

Last week when I went into a morgage finance fund, again not a single expert recommending the morgage finance sector, the same newsletter has a sell on the fund, my first week, up 7.5% return.

By getting in when fear is high it produces huge gains, we'll see what the next few months holds for morgage finance.

Today I'm 95% in stocks.

What happens with many of the experts is, just like you they want to play it safe, they want to see more recovery, more market upside, more good news and they miss out on the biggest gains which come at the bottom.

Then when they finally feel safe enough to recommend something or to go back into the market by this time the people who been in at or near the bottom have scored huge gains, so when these experts start recommending things and the masses of people start to feel safe and throw money back in those at or near the bottom have now scored very big gains and they begin to cash out and take their profits, and we see some downside then the guys who felt safe who got in late now are nervous as hell again and many pull out with a loss, sound fimilar ??

And it all starts by being afraid to get in when fear is high.

Just for the record, the morgage finance industry was up today 2.47% which ranked about 15th of the 146 industries tracked by barrons.com.

Although my fund did slightly lagged the market.

| By Lennox on Thursday, August 13, 2009 - 04:11 am: Edit |

"One of the key things I learned from years in the stock market is, never, ever make a investment decision based on trying to predict a future event, make investment decision based on known facts and value."

Fool's quote above indicates a lack of understanding of the market. Currently available facts and value are priced into the market. The stock market is forward looking, so investment decisions must be made based on where you see facts and value going, not what they currently are. Anything that is forward looking is going to contain a predictive element.

Exactly, investors are always looking forward, buying stocks today on anticipation of what the economy will look like in 3 or 6 months from now.

You make this prediction, (yes it's a prediction to some degree but that's different from what I was refering to above) based on how the news comes in week to week, month to month, quarter to quarter, those predictions are made by using the facts of the economy as they are today.

The predicitions I'm talking about are for example, some anaylst will say we see oil prices at $150 a barrel next year so because of this we advise you to invest in this manner.

Or as Duetche Bank try to predict home prices will be down 14% in 2011 therefore homeowners will owe more than their homes are worth therefore they'll more likely could default into more foreclousers, there's just way to many vairables to make this prediction and be right.

No matter how smart some-one thinks they are they will never consistently make those prediction and be right , it's impossible.

Bad news hit the morgage finance industry, with forecloseres up 7% in july, however it didn't make a difference, it keeps rolling along.

Morgage finance rolled again yesterday easily beating the overall market, up 2.14%, ranking 21st of the 146 industries tracked by barrons.com.

Today morgage finance easily beats the market again, with the markets down just under 1%, morgage finance broke even, ranking 12th of the 146 industies.

When ivestors are looking forward, they are simply following the trend of the market news, that's not making a prediction, I suppose you could call it making a prediction but it's not really, it's just following the up or down trend of the news as it comes in.

An example would be if black comes up 5 times in a row on a roulette wheel and someone puts their money on black for the next spin, did that person make a prediction ??

No, they followed the trend of the wheel, investors in the stock market do the same thing for the most part.

There's a difference between making a prediction and following a trend, making a prediction is someone saying I predict earnings will be way up next quarter or way down and therefore I make my investment decisions based on this prediction, not good.

Following the economic trend is someone using the actual, factual news as it comes in and just anticipates it will continue in the same direction down the road, therefore they make their future decision on where the economy will be 3 months or 6 months if the news continues coming in about the same, much better approach.

Investors also look at the big picture, where has the market been, is it coming off 3 or 4 years of economic prosperity, has the economy peak and now in a slight downhill trend, or is it still growthing faster than 1 year ago and 2 years ago, has the stock market been on a 3 or 4 year bull run driving up prices, where are the prices of stocks now VS the economy now ??

Looking at the big picture now, we're coming off a big recession, stock prices got hammered, and now the news is getting slowly better, this is why the market can go up so dramatic with a not very good economy, looking at the big picture, it's because of where we've been, stock prices in march were unvalued.

Investors also look forward when bad news is coming in, when news is bad and getting worse investors anticipate this getting worse to continue, therefore they sell-off based on things becoming worse 3 or 6 months out, but when things don't get worse now stocks are undervalued.

Economic situation is obviously important, also important is where we just came from and where stocks have been, are they driven way up, overvalued or driven way down, undervalued comparable to the economic news.

And that's what I'm refering to when I say make your investment decision on know facts and value.

| By Lennox on Monday, August 17, 2009 - 07:28 am: Edit |

"...anticipates it will continue in the same direction down the road."

This is the prediction part and it's just as big a prediction as any other.

Random stochastic processes, like coin flips and roulette wheels, don't have "trends." Each flip or spin is a unique process, independent from the proceeding one(s). Unless the coin or the wheel is biased, you can only guess (predict) what will happen on future rolls or spins. If you get 5 heads in a row, the probability of it being a head again is .5 (same as its being a tail).

The stock market is full of quasi-randomness (several books written on this topic in the last 5 years), but it is not a random process in the sense that a roulette wheel is. Many market trends are "real" trends, unlike the example of black coming up 5 consecutive times (which is an unusual event, but has no bearing on what will happen on the next spin). But few investors , even very experienced ones, are good at reading trends and figuring out when trends will shift, as they inevitably do.

So I don't understand the point of the advice offered.

I have seen Markets described as "Non-Linear Systems". One attribute of non-linear systems is "sensitivity to initial condition". This attribute holds that any non-near term exact prediction is absolutely worthless. These systems can be described mathematically but description does NOT give prediction.

In order to to predict a market result, you would have to know EVERYTHING about EVERY ELEMENT, EVERY ACTOR and EVERY INTERACTION. There is NO APPROXIMATION that is "good enough".

This is generally considered... not very likly.

The most famous example of market prediction gone wrong was about the firm "Long Term Capital Management". They embodied what were know as the "Quants" Wikipedia article

The net of it to me is, If someone is selling a scheme to get rich, it is to enrich the seller, not the buyer, and, you can't "beat the system".

Agreed. The smartest institutional investors I know will all tell you that no matter how good and analytical you are, you'll win sometimes and lose sometimes. Timing the market is a losing strategy, and the only way to win in the long run is to be in it for the long haul. Having more information is better than having less information, but it guarantees nothing, and anyone who tells you otherwise is out for himself and not on your side.

Think of it like craps, by far my favorite game in a casino and the one with the best odds. On any given roll, there are a number of ways to win and a number of ways to lose. Today the markets dropped, but a lot of shorts won. Tomorrow it may crank and the shorts will bust. I sell a stock and it drops 50 cents, the guy who bought it from me loses. I sell a stock and it goes up 50 cents, the guy wins. I always laugh when guys say, after the fact, "I was smart and got out of the market." Well, if you were really smart and could have predicted what happened, you would have gotten into the market hard and shorted like crazy.

There's a excellent book about gurus who try to predict the future not just in the stock market but in general.

In 1985 William Sheraden began looking into gurus who try and predict the future, he's down alot of reasearch into it and covers stock market gurus very well, including reports by many others who've tracked stock gurus over time.

The book is called "THE FUTURE SELLERS" and is available at amazon.com.

His research and the research of others he's come across all shows the gurus who try to predict things like, inflation, interest rates, earnings, turning points in the economy,etc., "DON'T DO WELL".

Such predictions as those in bluelights article by deutche bank, that home prices down 14% in 2011 or the prediction in the other article that says the stock market will retest the lows of march are just impossible for anyone to make accuratly.

Then he goes on to say, of all the methods he's look into and researched, the method that produces the most accurate info is just what I posted above, simply following the trend of news on the economy gives you the best chance to accuratly call the future.

In regards to all the negative things being said about the housing market in the articles posted here and seen else where, Jim Cramer on his show 3 or 4 nights ago, came out and specifically commented on these.

He said, "BE CAREFUL WHAT YOU BELIEVE IN REGARDS TO ALL THE NEGATIVE THINGS BEING SAID ABOUT THE HOUSING MARKETS, THERE IS NO EVIDENCE TO JUSTIFY THESE NEGATIVE REPORTS".

Then goes on to say the "EVIDENCE", and the key word here is "EVIDENCE" (not predictions) all points to the housing market bottoming and improving, this coming from the big home builders and realators.

Realators across the country are reporting inventories down and demand up.

Well if one is looking for evidence, do you place faith in the claims of realtors?

Home prices up for the 2cd straight month and for the 2cd quarter, which was the 1st quarterly rise in 3 years.

And the morgage fiance industry rolled because of it, going up 3.94% yesterday which ranked 3rd of the 146 industries tracked by barrons.com.

Morgage applications up 7.5% this past week, with buying a home applications up for the 4th consecutive week.

Home sales report comes out today, will likely be positive and we'll see if the morgage industry gets another big boost.

Past 1 month coming into this week morgage industry index was up 19.5%, ranking in the top 20 of the 146 industries tracked by barrons.com.

Fooledagain1 - why are you touting RE here?

How's everyone doing ??

Still reading those doomsday articles ??

Just for the record, stocks are cheap relative to earnings, in fact, they're the cheapest they've been for years and years, you'd have to go all the way back to 1986 to find a time when stocks were as cheap as they are today relative to earnings.

And 1986 was at the beginning not the end, but the beginning of the incredible run that brought us all the way to 2000 with huge returns in the stock market.

Just wanted to check-in with the doomsday article that said we'd retest the march lows, not looking like such a good "prediction" at this time.

Stocks are cheap, the economy is improving, what's not to like about this stock market ????

When the market rises in concert with precious metals it can be interpreted as a bad sign for the currency. As if we needed any more signs of the dollars precarious position.

Best of luck to you, but I would look outside the United States if I were investing in equities. I would also wait and see if we are forced to raise interest rates to make more palatable to furriners the financing of our debt and how badly this will effect real estate prices.

I'm doing well FA== thanks.

Not much to report, took a fair amount of profit off the table this week, playing with house money, and will put it back in on any fair to middling pullback.

I'm not smart enough to guess the right time, but do enjoy sticking profits in my pocket.

Nice, glad to hear you scored.

Yea, I would suspect a pullback would be coming along at some point, but wouldn't be surprise if we don't see one.

Coming out of the past couple of reccessions there was no correction at all.

The other interesting thing about past reccessions is, coming out of large contractions in GDP, such as we've seen in 2007-2009, growth has come back strong, much stronger than any of the analyst are calling for.

In the 1st 2 quarters of positive growth coming out of a large contraction, every single time in history it's been at least 6% growth.

75% of the time growth is 7.5% or better in the 1st year out of large contractions.

Analyst are calling for 2-3%. History shows double what the analyst are calling for.

And thus far everything is beating the street, earnings, growth, if this continues, it's very possible we won't see any correction at all.

Stocks are still cheap, relative to earnings, in fact, you'd have to go all the way back in 1985 to find stocks this cheap.

There's still alot of fear on the sidelines, and remember, the analyst have been wrong every step of the way since the march lows.

Did anyone see the Kudlow Report last night ??

He said the leading economic indicators are pointing to a monster economic recovery, much larger than the analyst are predicting.

Much like what history shows in my post above.

It looks like those doom and gloom articles posted here are being washed out to sea.

Better get in now, once "big news" hits the stock market could explode.

2 years from now you'll be kicking yourself over and over again if you don't get in this market.

No, but has he ever said anything different? He's been talking about bullish inverted yield curves since last November.

| By Laguy on Wednesday, September 23, 2009 - 06:29 pm: Edit |

I try not to follow the prognosticators very closely as most of them get the trend line (up or down) right about half the time. But I want to throw something out there and ask whether my thinking is flawed.

Wasn't the Dow around 14,000 a couple of years ago? And it is below 10,000 now. The difference was not because of a bubble (at least nothing like the NASDAQ bubble that ended up killing many of us), but some real financial turmoil with some business cycle stuff thrown in. If the turmoil and economy gets straightened out, shouldn't the Dow (and the S&P 500, which has shown a similar trend) go back to where it was, and beyond?

Of course, if the economy does not recover well, or there are other negative events, the market may not do well. But using my simplistic (overly simplistic?) analysis above, it seems the upside potential right now is rather high.

| By Buick on Wednesday, September 23, 2009 - 09:35 pm: Edit |

laguy,

the other day i was talking with my father and we were figuring exactly what you've said. we should be able to get back to new highs sometime since real companies supported the stock prices this last time out (unlike the 2000 nasdaq lie).

it just a question of when the consumer gets enough money in their pocket to start spending. knowing the american style of spending when you don't have the money, i expect the spending to start next year. and the emerging markets are getting more consumer spending every year. still dwarfed by the US but growing nonetheless.

that said, i have sold almost everything i own over the last few days. kept some solid dividend plays like MO, PM, and LLY. i did buy some calls with a small portion of the "cash out" in case i'm horribly wrong and we see S&P 500 at 1300 in two weeks.

i think i can re-enter the market cheaper in next 30-45 days. i'm guessing Q409 revenue for most companies might actually be above Q4 08 levels. all the analysts are talking about good earnings but bad revenue. so i want to be back in the market for the quarter where the revenue beats.

some investors can just look two years ahead and hold w/o stress. i think anyone in that boat is in good shape.

| By Catocony on Thursday, September 24, 2009 - 06:53 am: Edit |

The problem isn't lack of cash - the US and the world is floating in cash right now. It's lack of confidence for the short term, and still a lack of visibility over the long term.

| By Beachman on Thursday, September 24, 2009 - 09:28 am: Edit |

The US is "floating in cash" we are trillions of dollars in debt but we are floating in cash. What a stupid assessment. As long as it is borrowed "cash" decades and decades into the future we are "floating in cash right now."

Catocony..... that is the same attitude of the millions of Americans who thought they were floating in cash when they had 125% lines of equity loans and available credit lines on the credit cards. What happen then....all that floating cash disappeared!

| By Catocony on Thursday, September 24, 2009 - 09:58 am: Edit |