As you can see there's a 1% fee on each withdrawal, be it Thailand or the Philippines. Beats the hell out of the 5% to 7% in bank fees BofA was hitting me with when I'd use a Philippine ATM with a max withdrawal limit of about $100 per transaction.

| By Bendejo on Thursday, January 18, 2007 - 04:45 am: Edit |

Last year at this time Citibank did not have a fee for withdrawing money from a non-Citi ATM. In fact, I did some research in Brazil and found that using another bank on the PLUS system yielded a slightly better exchange/all-around transaction payout than a Citi ATM.

Some time in the past year Citi initiated a 1% non-Citi ATM fee, which they recently upped to 3%.

In looking for a new bank with foreign ATM transactions in mind, I've come across Washington Mutual. I've received offers from them in the past that looked good, but failed in the fine print.

Now they say that with combined checking/savings accounts (paying 5% APY) you get free checking, the fine print stating:

*WaMu will not charge ATM fees for cash withdrawals, but non-refundable ATM operator fees and foreign currency exchange and transaction fees may apply.

Well, as Tom Waits said "the larger print giveth and the small print taketh away." While there is no fee listed, they can sock it to you on the exchange rate ("that was the given rate at the time of your transaction, sir"), and then PLUS/Star/et al could tack something on, etc. And then perhaps they have their foreign currency exchange set fees which, oh darn, we keep forgetting to mention.

Anyone out there using WaMu, or getting what they think is better foreign transaction deal?

| By Catocony on Thursday, January 18, 2007 - 05:36 am: Edit |

Wachovia, on a CAP account, gives me the LIBOR exchange rate and only charges the 1% fee on the transaction. No ATM fees from the bank's part. Always use HSBC in Brasil since they don't charge a POS fee of R$6 or whatever like Citibank charges.

| By Xenono on Thursday, January 18, 2007 - 07:24 pm: Edit |

I have a basic free WAMU checking account. It costs nothing to maintain and comes with a free Gold Cirrus Network MasterCard debit card.

I recently used in Angeles. The exchange rate was in line with what was posted on Yahoo! or XE at the time of the withdrawal. They also charged a 1% transaction fee, which comes from MasterCard, not from WAMU, I believe. No other fees were charged. No ATM fees from the Filipino ATM and no ATM usage fees from WAMU.

They also donít charge to do online transfers from another checking account. It usually takes about five or six business days to transfer money in or out, but they donít charge for it. This is good, because WAMU doesnít have a branch in my city. You also don't have to get the savings account to get the free checking. At least you didn't when I signed up as I only have free checking.

Iíve been very happy with the basic free checking account.

More info:

https://online.wamu.com/direct/apply/page/StartApplication?appType=FC

Signup:

http://www.wamu.com/personal/accountchoices/checking/default.asp

quote:*WaMu will not charge ATM fees for cash withdrawals, but non-refundable ATM operator fees and foreign currency exchange and transaction fees may apply.

| By Phoenixguy on Thursday, January 18, 2007 - 08:32 pm: Edit |

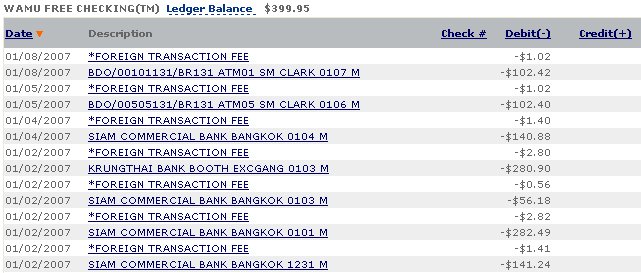

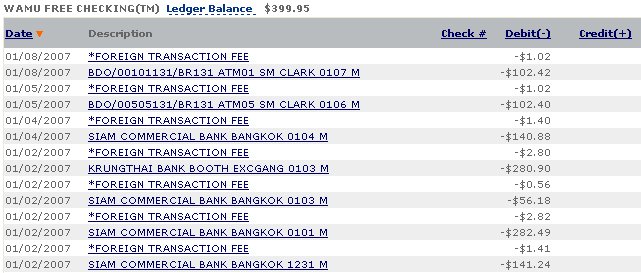

I recently took a trip to Thailand and the Philippines. Here's a list of ATM withdrawals and fees from my WAMU mongering account:

As you can see there's a 1% fee on each withdrawal, be it Thailand or the Philippines. Beats the hell out of the 5% to 7% in bank fees BofA was hitting me with when I'd use a Philippine ATM with a max withdrawal limit of about $100 per transaction.

| By Bendejo on Friday, January 19, 2007 - 10:00 pm: Edit |

Thanks for all that detail, PG.

I used BofA once and couldn't believe what it cost in the final tally.

(Message edited by bendejo on January 19, 2007)

| By Segue99 on Friday, January 19, 2007 - 11:31 pm: Edit |

HSBC Direct, which is an online account only (although you could get a regular account too I suppose), gives good interest and imposes no ATM withdrawal charges. The only hiccup is that while you can make transfers to your account from another bank (at NO cost), it takes a few business days.

| By Reytj on Saturday, January 20, 2007 - 01:09 pm: Edit |

While BofA may not be a good choice for the Phillipines it is for Mexico. You can make withdrawals from Santander Serfin ATMs with no fees.

| By Marley on Wednesday, January 24, 2007 - 05:36 pm: Edit |

Commerce bank. I believe it's a new jersey bank but you can get a free checking acct from anywhere in US online and then deposit the money from your regular banking acct. The base level checking acct is free for one year, after that you have to keep $100 minimum balance. On that account you get a Visa debit card on which you will pay 0% foreign currency conversion charge on foreign atm withdrawals, and pay no atm fees to Commerce bank on the first 10 withdrawals per month, after that $2 per. If you keep a balance of $5K or something like that they even reimburse you for non commerce bank atm fees charges, seriously. It's the best deal I can find for mongering atm card.

| By Wurldmonger on Monday, July 07, 2008 - 09:49 am: Edit |

I used my WaMu Checkcard at the Santander ATM in TJ recently to see what the difference was between that and my BofA. I withdrew $1000 pesos. At the time, the exchange rate was at 10.31 according to Google. The actual withdrawal came out to be at u$s 97.12 with a u$s.97 foreign transaction fee, which comes out to approximately a 10.296 exchange rate. Obviously, the more you take out, the lesser the foreign transaction fee is going to matter.

Comparing this to BofA, which charges not only a $3 non-BofA ATM fee, but another $5 foreign transaction fee. The exchange rate is about equivalent (I didn't want to waste $8 for this experiment to serve as an example). Not that I think WaMu is a particularly great bank or anything, I do like the no-fee checking account. You do have to keep at least $300 in a Savings account with them in order to avoid a $4 account maintenance fee. But, with this account, you get FREE foreign or domestic wire transfers, and a pretty good Savings rate (only 2% lower that current inflation rates).

I guess banks are having a rough time raising deposits, to have Savings rates up relatively high compared to say, Money Market accounts and most CDs. Next time, I'll try to use my HSBC account in the HSBC branch in TJ. Hopefully this will have a better rate than the WaMu account.

| By Roadglide on Monday, April 20, 2009 - 12:03 pm: Edit |

Any recent experiences with Citibank? I am thinking about opening up a Citi gold account.

RG.

| By Xenono on Monday, March 15, 2010 - 09:42 pm: Edit |

Well Chase/Wamu is officially dead as a decent deal. Wamu was so much better before they went belly up and Chase bought them.

Chase still keeps the checking account free, but they charge $3 per foreign ATM transaction now.

This has lead to back to good ole BBVA Compass. Compass was acquired by Spanish BBVA in 2007, but they still have a limited presence around the US. Although since they bought the failed Guaranty bank, they now have free checking and free ATMs worldwide for customers in Alabama, Arizona, California, Colorado, Florida, New Mexico, and Texas.

The one big thing I don't like about them in their Visa check card. I have had the toughest time finding Visa ATMs in Asia. I have much better luck with MasterCard debit cards.

Which leads me to the account I just opened.

http://www.ally.com

Free checking and free MasterCard debit card. The checking earns .50% interest. 15K earns 1.15% Their CDs and Savings have some damn good rates as well.

No brick and mortar (all online), but they are FDIC insured and you can easily ACH (electronically transfer) to and from them from your existing checking accounts for free. They are a unit of GMAC Financial Services.

They also have 24 phone service. Haven't called them yet though, so no idea if it is the US, India, or the Philippines you are calling.

| By Roadglide on Tuesday, March 16, 2010 - 09:29 pm: Edit |

My Credit Union charges me a 1% foreign exchange fee on purchases, my CITI Gold credit card hits me up with a 4% fee, however my CITI Gold ATM waives the exchange fee on ATM transactions and purchases, plus you don't have to worry about bumping up against a daily limit on ATM transactions because they set it up on the high side with this card.

I just use my ATM card for everything that I can, and the Credit Union card for what I can't. Down side is I still get nailed for the 150bht ATM fee.

| By Baxter on Wednesday, March 17, 2010 - 09:38 am: Edit |

You might try Union Bank of California; with Priority Banking status they charge no fee for ATM withdrawals plus they pick up the fee any local ATM might charge you worldwide, such as the infamous 150 baht. You have to watch your statements carefully though, as they do let some slip through. When you call them on it they're quick to fix it.

Priority Banking doesn't come cheap, you need to have 100 K with them.

| By Phoenixguy on Sunday, April 04, 2010 - 08:45 am: Edit |

Xen, on my most recent trip (Feb 2010) to the Phils, I found that my Chase (previously WAMU) MasterCard didn't work in the BDO ATM's in all the malls there. Had to fall back to using my BofA Visa. Had to try 3 or 4 ATM's before I found one that would take the MasterCard.

| By Khun_mor on Sunday, April 04, 2010 - 10:01 pm: Edit |

Phoenixguy

I had the same problem this past trip in February.

WAMU cards formerly worked fine in the BDO ATMS throughout the mall. Now that is a Chase card it worked in none. I never called customer service to find out why. I just used my BofA ATM in the ABC Hotel ATM machine the rest of the trip.

| By Catocony on Monday, April 05, 2010 - 01:24 pm: Edit |

I've been enjoying using my E-Trade account the last 18 months or so. No international fees at all. I like to transfer what I plan to withdraw from one account to the other just before I hit the ATM, just in case my card gets cloned or if it gets stolen. E-Trade isn't as good as Wachovia where transfers between accounts are instantanious 24x7x365, with E-Trade it's only during business hours. But, with no fees, I'll take that slight inconvenience to pick up the extra 2-3%.

| By Mangaman on Sunday, August 07, 2011 - 02:04 pm: Edit |

My bank used to credit any local ATM fees of any other banks world wide, but have instituted a policy change that will do away with this benefit in September, so Im looking for a new bank that will offer this benefit. What banks are still offering no fee ATM use worldwide without requiring huge minimum balances?

| By Catocony on Sunday, August 07, 2011 - 03:09 pm: Edit |

If you're talking about the POS fee, I'm not aware of any banks that cover that since it's lumped into the withdrawal amount, thus your bank never processes - and thus sees it - as a separate fee.

That said, at least where I travel, the only bank that does charge a POS fee is Citi. In Brasil I'll use HSBC, Bradesco or Banco do Brasil and none charge a POS fee.

| By Laguy on Sunday, August 07, 2011 - 05:15 pm: Edit |

Schwab (at least for the type of ATM card I have from them) rebates the ATM fee and charges no currency conversion fee. Hopefully, they are not the one Mangaman is referring to when he speaks of a new policy.

Capital One Bank claims the same, although when I read the fine print it said something about all domestic ATMs and "some" or "many" international ones. I haven't used their bank card internationally yet, but I suppose someone who has it either could fill us in, or perhaps someone (me perhaps if I can an unlazy moment) could telephone them to find out the details of which international ATMs they do this for.

I'm assuming Cat's POS fee reference is to "point of service" fees, which would then mean the fees the actual ATM bank charges for using their ATM, usually in the range of one to five dollars. In fact, Schwab apparently does know much this is because in every case a separate line in my account history shows the rebate amount for each ATM transaction. This is particularly helpful in Thailand, where these fees are on the high side.

| By Xenono on Sunday, August 07, 2011 - 05:38 pm: Edit |

LAGuy:

What are the requirements for a Schwab checking account? Minimum deposit, balance, brokerage account, etc?

That is probably the best deal given they rebate other banks fees, don't charge fees and there are no foreign transactions fees.

I still like Ally (www.ally.com) for a totally cheap and free checking account.

No minimum balance, no monthly fees, no ATM fees from Ally and they rebate the fees other banks charge.

You DO get dinged with a 1% foreign transaction fee that is non-refundable.

For example, see below.

Amount: $236.52

Description: xxxxx

Posting Date: xx/xx/2011

Posting Time: x:xx AM

Effective Date:

Type: Withdrawal

Transaction Fee: $4.59

Cross Border Assessment Fee (CBA): $1.84

Currency Conversion Assessment Fee (CCA): $0.47

The $4.59 fee the ATM charged me is automatically refunded back when the statement closes. The CBA and CCA fee are 1% of $236.52 - $4.59 = $231.93.

1.84 + .47 = 2.31 or 1% of 231.93.

A few years ago the ATMs in the Philippines never charged an ATM fee. Now a lot of them do and I think the ones in Thailand do as well.

| By Catocony on Sunday, August 07, 2011 - 06:45 pm: Edit |

LA,

That's good, although in Brasil, POS fees aren't an issue. Some places they seem to be, others not.

| By Laguy on Sunday, August 07, 2011 - 07:16 pm: Edit |

Xenono: I got my Schwab account a long time ago, and because I keep a reasonable amount of stocks in my account I haven't had to deal with minimum deposit requirements. I have no idea what it takes to start one of their accounts (and I don't know whether all accounts including those through Schwab bank have the same deal on ATM fees (or lack of fees)) but you may want to see whether the info is available on their website, www.schwab.com.

As to my earlier post above, sorry about the typos ; I don't know whether it was bad cut and pasting, over-erasing or what, but a few words are missing. Can I use the pain killers for the tooth problem soon to be a root canal procedure as an excuse? And don't worry, I'm not going to turn into a Rush Limbaugh.

| By smitopher on Monday, August 08, 2011 - 08:05 am: Edit |

I just opened a Schwab account. I did all the setup online. No money required to open the account. I went to a Schwab office to make my first deposit. They do not send the ATM card until you "fund" the account with a deposit. No fees. Card is a "VISA" branded debit card with "Interlink" and "PLUS" network symbols on the back.

NOT FDIC Insured so only fund it for use as a cash source while traveling. You can setup no fee transfers from you main account. Takes 3 business days to complete.

Still rebates all ATM transaction fees world wide. I have not received any notice about a change.

You actually have to first open a brokerage account. Then you can open the "High Yield Investor Checking" account. I did it all online.

So far I have not deposited anything in the brokerage account.

| By smitopher on Monday, August 08, 2011 - 08:21 am: Edit |

Last month I made 4 ATM withdrawals in Angeles City.

I was rebated $18.63 in ATM fees.

Effective rate on the transaction with the worst rate was 42.84 Pisos per dollar.

According to oanda.com, the rate for that week i was in Angeles ranged from 42.7740 to 42.8988

I seem to recall that money changers were offering 42.5 or 42.3

(Message edited by smitopher on August 08, 2011)

| By smitopher on Monday, August 08, 2011 - 08:45 am: Edit |

Whoops, just checked. Schwab Checking account is FDIC insured.

From website: Schwab Checking FAQ

| By smitopher on Monday, August 08, 2011 - 08:53 am: Edit |

One last thing about the account, Schwab has an iPhone and Android app. You can make deposits by using the phone camera to take a picture of the check. Wow, I wonder how that works. I have not tried that yet.

| By I_am_sancho on Monday, August 08, 2011 - 01:13 pm: Edit |

I didn't know Schwab was no minimum balance, no fees on the checking. That sounds like a heck of a deal. I just now opened an account. Seems like I have to snail mail them a form and a voided paper check to link it to my other checking account in order to fund it on-line, but otherwise only took a few minutes to open the account and I assume once they process this silly paper form I will be able to move money back and forth from my credit union on-line or with the Android app.

I still don't intend to end my "never used an ATM in PI" streak though.

| By smitopher on Monday, August 08, 2011 - 04:12 pm: Edit |

Why the hell not? Since ALL ATM FEES are rebated, you can use any of the convenient ATMs AND get a better rate than the best money changers AND not have to carry allot of USD. There are:

quote:I still don't intend to end my "never used an ATM in PI" streak though.

| By Laguy on Monday, August 08, 2011 - 06:33 pm: Edit |

"Why the hell not?"

It is probably just another one of IAS's impossible to understand fetishes.![]()

| By I_am_sancho on Monday, August 08, 2011 - 06:59 pm: Edit |

EXACTLY.

I'm opposed to all this new newfangled development, ATM's, functional banking systems and all that kind of stuff going on in Angeles City these days.

| By I_am_sancho on Monday, August 08, 2011 - 07:51 pm: Edit |

Looks like I'm able to fund the account on-line by pushing an ACH transfer from my credit union. So I pushed over some money so now they should send me my ATM card. I mailed in their paper form too but it looks like having my credit union push the money seems the fastest way to move money. So indeed it looks all 100% free, no minimums, no fees, no DLD's when you aren't looking. Thanks for the heads up Laguy and smitopher. I WAS previously aware that Schwab had no foreign exchange fees and refunded ATM fees. I WAS NOT previously aware they had no minimum requirements whatsoever for having such an account.

| By Roadglide on Monday, August 08, 2011 - 08:39 pm: Edit |

Yeh but will they refund to you that 150bht fee that the Thai ATMs all seem to charge?

| By I_am_sancho on Monday, August 08, 2011 - 08:58 pm: Edit |

The others here would have to confirm but it sure looks to me like the 150 baht fee would be refunded. Plus they are even refunding the "legitimate" 1% Visa exchange fee.

| By Laguy on Monday, August 08, 2011 - 09:08 pm: Edit |

Yep. ATM fee refund, 150 baht Thai ATM fee refund: same same.

| By smitopher on Tuesday, August 09, 2011 - 12:14 am: Edit |

The PI banks have followed in the footsteps of the Thai banks. They all charge a 200 piso fee. Schwab refunded all of them to me last month.

(Message edited by smitopher on August 09, 2011)

| By Paulyvegas on Tuesday, August 09, 2011 - 02:12 am: Edit |

Took 5K cash thinking it would be enough for the month. Wrong. Now I'm into the ATM's and the fees are savage. Example: Took out $500 in two hits of $250 each (it only allows 10K per transaction). They get you for 200p for each = $10. Then my bank gets me for 3% of total transaction money =$15.

Thus, to have access to $500 of my money costs $25.

Brutal.

| By I_am_sancho on Tuesday, August 09, 2011 - 08:22 am: Edit |

I should mention the Schwab did a hard pull on my Equifax which kind of pisses me off because a. I didn't see it mentioned in anything I agreed to opening the account and b. opening a checking account is not the same as applying for credit. I don't see what rule says they couldn't just do an account review soft pull if they really want to see my credit. In any case I'm riled by the unannounced hard pull on my credit report.

| By smitopher on Tuesday, August 09, 2011 - 08:30 am: Edit |

That sucks.

quote:In any case I'm riled by the unannounced hard pull on my credit report.

| By smitopher on Tuesday, August 09, 2011 - 08:39 am: Edit |

That is exactly why I started looking for a better way to use my ATM card. The fees in Thailand and the PI really pissed me off. Now I'm back to the feeling that my Schwab Debit card is the Primary method of getting cash. I always take 3 crisp and new $100 bills for "emergencies" and use my credit union credit card for hotels and restaurants.

quote:Thus, to have access to $500 of my money costs $25.

Brutal.

| By I_am_sancho on Tuesday, August 09, 2011 - 08:45 am: Edit |

It's not really that big a deal, hard pulls generally knock like 5 points off your FICO score and it mostly comes back in 6 months, all the score comes back in a year and they drop off in two years. I'll survive. ![]()

The main reason it riles me is I'm kind of pushing the envelope anyway with number of new credit cards lately because of all the frequent flyer mile sign-up bonuses. One more hard pull does not help that game any and as a general rule I expect to get at least 40,000-50,000 frequent flyer miles out of a hard credit pull.

I'll get over it. ![]()

| By Laguy on Tuesday, August 09, 2011 - 02:36 pm: Edit |

By any chance did you catch the British Airways 100,000 mile promo? You had to spend $2,500 in the first three months to get the second 50,000, but it was a good promotion notwithstanding how British Airways reams you on various charges when you use their miles.

I don't know if it was targeted, but in any case it is over. It did, however, somewhat enhance my miles multi-millionaire status. Now if only miles were dollars (or Euros)!

| By I_am_sancho on Tuesday, August 09, 2011 - 07:18 pm: Edit |

I applied for the BA card but was denied by Chase due to having the 50k CO card from then, two AA 75k cards and an Ameriprise card (lounge access)all within a 6 month period. Hence my aversion to hard credit pulls at the moment. I took that as a hint from Chase to knock off the new apps for a few months ;)

Those BA miles should serve you very well in Cathay Pacific First class. Even with the Bullshit fees BA imposes.

| By Laguy on Wednesday, August 10, 2011 - 01:21 am: Edit |

It does seem like with every new Chase application I mae (first the Continental President card, then the Priority Club card, then the British Air card, and most recently the Hyatt card) they take longer to approve me. With the Hyatt card they didn't approve for maybe two or three weeks. But so far they haven't cut me off.

Having said this, I still hate Chase, but when they give big incentives to grab their cards, and don't charge foreign currency conversion charges (at least on any of the ones I have), it is hard to resist doing late-night-while-drinking-Bourbon internet applications for them.

| By Gggmaddux on Wednesday, August 10, 2011 - 11:33 am: Edit |

http://www.mychasecreditcards.com/ihg/pcrofferspage260k Laguy Is that the same offer you received for the Prioirty Club 60K Points? Application was instantly approved.

The CO offer was only 25K that I saw after first purchase, did you have another offer that I'm missing?

| By Laguy on Wednesday, August 10, 2011 - 12:38 pm: Edit |

I don't recall the offer from Priority Club as it was maybe six month ago. Similarly for the Continental card.

Note that although the very expensive Continental Presidential card does not charge currency conversion fees, the other Continental Chase cards may still do so. If so, this contrasts with the Priority Club card, the Hyatt Card, and the BA Card, all of which (to my knowledge) do not impose such fees.

| By I_am_sancho on Wednesday, August 10, 2011 - 05:42 pm: Edit |

After a couple of days and finally getting all the ACH money transferring setup, I'm really liking this Schwab checking allot. I'd say there is a good chance I may even go with it as my primary bank account. The android app and free everything cinches the deal.

| By smitopher on Wednesday, August 10, 2011 - 08:05 pm: Edit |

quote:IAS chirped: I'm really liking this Schwab checking allot.

IAS, you are a man of strange strange desires.

quote:LAGuy cooed: It is probably just another one of IAS's impossible to understand fetishes.

| By Hunterman on Thursday, August 11, 2011 - 11:11 pm: Edit |

I got the BA card (and the miles), but was pissed when they charged me $95 "membership dues" in the first month. I don't recall seeing that mentioned (of course, I never read beyond the "miles offered" part). Still, cheap miles.

| By I_am_sancho on Monday, August 15, 2011 - 10:42 pm: Edit |

Received my Schwab ATM card in the mail today so 7 days exactly from applying on-line to apparently being ready to go. Pretty good service so far.

Also I should note. Schwab's credit card which also 'had' outstanding terms was through a partnership with FIA, aka B of A, aka Satan. This troubled me about Schwab before since of course I have great hatred for B of A. But I am happy to find out now, Schwab has broke off their relationship with Satan in recent years and in fact Charles Schwab himself is actually a major contributor to the RNC so I can also feel socially responsible sending my business to this financial institution. I would like to thank you guys for bringing this to my attention.

In all seriousness though. If this card works as advertised I could not envision any more favorable foreign ATM scenario. Unless there is an unforeseen gotcha I am missing this is indeed 100% perfect and everyone should have a Schwab checking account.

Sincerely, thanks to the guys who brought this up. I should have known about this account a long time ago. It's a heck of a deal.

| By Xenono on Tuesday, August 16, 2011 - 10:44 pm: Edit |

I finally signed up tonight. Looks like the "Brokerage plus Schwab bank checking" is completely free, along with all the benefits mentioned above.

Only thing I don't like is the Visa debit card as Visa compatible ATMs are still a little harder to find in AC.

| By I_am_sancho on Wednesday, August 17, 2011 - 01:13 am: Edit |

Xen, I'd have to do a search but I somewhat vaguely recall that someone around here (very possibly even you) once said the ATM at Jollibee takes Visa.

In any case I personally still don't fully trust any ATM in Philippines and will have cash in my possession to bankroll my trip just for peace of mind.

I'll be back in two weeks though so I'll give the Schwab ATM card a couple of small test drives and keep careful notes of prevailing on-line and Normas exchange rates on the same dates for comparison.

| By smitopher on Wednesday, August 17, 2011 - 10:41 am: Edit |

Just about EVERY ATM in AC now accepts VISA.

IAS, I will be back soon, hopefully at the same time. You owe me a Santos/Raymond ST... ![]() , Actually I have a favorite at Matrix Braun.

, Actually I have a favorite at Matrix Braun.

(Message edited by smitopher on August 17, 2011)

| By I_am_sancho on Tuesday, September 06, 2011 - 11:17 pm: Edit |

Schwab vs Normas

I tried out the Schwab ATM card this time.

Looking at what hit my account, and assuming the 200 Piso ATM fee is refunded at the end of the month.

10,000 Piso from the ATM at Jollibees debited my account for 10,200 Piso (I assume, haven't got the itemized statement yet) This resulted in a debit of $241.83 or apparently 42.18 Piso/1 Dollar and I assume the 200 Piso will be reimbursed so net cost for 10,000 Piso should be $237.08

The same date the rate offered by Norma's Money Exchange was 42 Piso even per 1 dollar. So the cost of funds for 10,000 Piso would have been $238.10.

So using the Schwab ATM card actually saved me about $1 per 10,000 Piso over cash. Since $1 will get me one beer during happy hour in ST bar, I'm not an accountant but in my book that means Schwab = free beer and therefore gets my stamp of approval.

And for comparison, using a Chase or other ripoff big bank's ATM card that charges $5 foreign ATM fee, 3% foreign exchange fee and doesn't reimburse the 200 Piso Philippine Bank ATM fee and assuming Chase doesn't further screw you on the exchange rate itself.... that same 10,000 Piso would cost $254.08 or $17 more than Schwab. Coincidentally. $17 would have got me 3 hours of blow job and boom boom in my hotel room from a ST bar lady and thus Chase sucks (but I hope you all already knew that)

Therefore, again I am not an accountant, but running the numbers scientifically seem to indicate to me that Schwab = free beer and Chase = pay up front for sex and then the lady runs off before she even does anything.

Someone with a $2,000 a week spend rate would be paying an extra $140 a week to use a Chase or other similar ripoff banks ATM card.

Although before I give up my cash, it is worth noting that on 2 nights I checked, 2 of the 3 convenient ATM's where entirely non functioning so there is a late night reliability factor to consider.

| By I_am_sancho on Wednesday, September 07, 2011 - 12:22 am: Edit |

And on further checking Schwabs rate that actually posted to my account vs published rates.

Schwabs rates EXACTLY match the Visa rates with 0% bank fee posted here.

http://usa.visa.com/personal/using_visa/consumer_ex_rates_us.jsp

It also appear the exchanges took place in virtually real time.

So it would be reasonable to assume the prevailing Visa rate at the real time that the transaction takes place is exactly the rate you get with no other costs associated with it anywhere.

These rates are extremely close to, but do not exactly match the "mid market" rate given by xe.com or the "interbank +/- 0%" rate given by oanda.com. The Visa rates do not exactly match either of those rates but the discrepancy is fairly insignificant.

(Message edited by I_am_Sancho on September 07, 2011)

| By Xenono on Monday, September 12, 2011 - 04:00 am: Edit |

I am sold on Schwab now as well. And Visa ATMs are now easy to find in AC.

With the Jollibee ATMs, one takes Visa and MasterCard. The other only takes MasterCard. I also noticed a PSBank near Love and Music at the Fields Beer Plaza that takes Visa and MasterCard and then across the street there is also a RCBC that takes Visa.

There is also another RCBC at the ABC Hotel and then of course all the BDO MasterCard only ATMs through SM Clark. And finally there is the ATM Center at SM that I think has a BPI and a few others, but I rarely use them.

So Ally will just be a backup for me now and I am a 100% Schwab guy.

I talked to Chuck and I liked what he had to say!

| By Robert Johnson on Monday, September 12, 2011 - 04:32 am: Edit |

Bank of America does not charge the international fee if you withdrawal at a Santander Bank in Mexico. Sometimes you have to remind them of their policy, and then they'll initiate a retroactive search, going back in time a few months.

You can get a free checking accont for several years, no min. bal., by presenting a college stud I.D. You are studs, aren't you? You know, students?

| By Xenono on Monday, September 12, 2011 - 04:50 am: Edit |

Bank of America has had their Global ATM Alliance for a while that is just a step better than completely worthless to me based on where I travel. But it may be valuable to some others.

None of the countries I visit regularly have banks in the alliance. Although I guess if I go back to China I can use China Construction Bank. I seem to remember seeing quite a few of them in Chang Ping and Chang An.

But you are still going to get dinged for the foreign transaction fee. Just not totally bent over at $5 by BofA and then again with whatever the foreign ATM charges. And you still have to go "hunting" for an ATM in the alliance to avoid the fees.

--------------------------------------------------

Traveling Internationally?

Use your ATM card or debit card within our Global ATM Alliance with no fees in the countries below.

BNP Paribas (France)

BNL d'Italia (Italy)

Barclays (England, Scotland, Wales, Northern Ireland and the Channel Islands)

Deutsche Bank (Germany)

Scotiabank (Canada and the Caribbean, Caribbean countries include: Anguilla, Antigua & Barbuda, Bahamas, Barbados, British Virgin Islands, Cayman Islands, Dominica, Dominican Republic, Grenada, Jamaica, Netherlands Antilles (St Maarten), St Kitts-Nevis, St. Lucia, St. Vincent & The Grenadines, Trinidad & Tobago, Turks & Caicos Islands, US Virgin Islands)

Westpac (Australia and New Zealand)

In addition, Bank of America has arranged for you to use your debit or ATM cards in China at China Construction Bank

ATMs (China Construction Bank ATMs in Hong Kong are not included) and in Mexico at Banco Santander with no ATM

Operator Fees or Non-Bank of America International ATM fees. An International Transaction fee for converting your

currency may apply.

http://locators.bankofamerica.com/locator/locator/LocatorAction.do

| By I_am_sancho on Monday, September 12, 2011 - 12:52 pm: Edit |

I used the Schwab card at both Jollibee's ATM's last week. One even posts to your account as Jollibees.

OCMU - ANGELES /JOLLIBEE ANGELES

The other posted as.

BANCNET BANK 028 PHILIPPINES

Of the two I noticed the ATM on the left was only functional one time the whole time I was there. The one on the right was always working but never had any paper to print out a recipt the whole time I was there. I never saw the ATM by 7/11 working and for a while that one just had a Microsoft Windows crash message on the screen.

| By smitopher on Monday, September 12, 2011 - 11:26 pm: Edit |

I've been here since 8/31

I have had 3 "off-line" atms, luckily the next one I checked was online. I've made over 12 ATM withdrawals. I'm really liking the Schwab ATM Card.